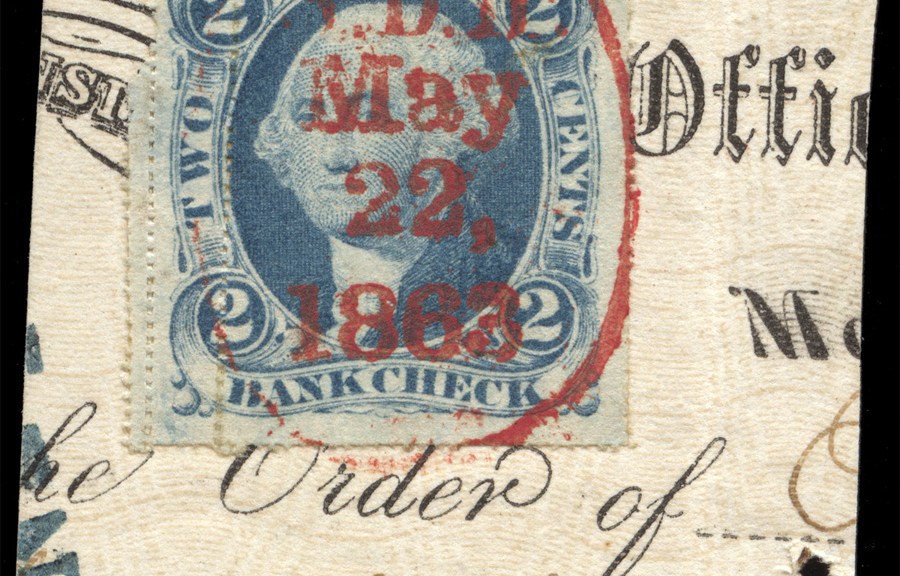

Hey, Why Don’t We Use Our Bank Checks As Advertisements?

While it’s not unusual to encounter bank checks feature branding, logos, trademarks, etc., this is the most exteme example of advertising I’ve encountered to date, featuring advertising content on both front and back of the check. I’m surprised that such a practice was deemed legal.